Shopify sales tax: All you need to know

Shopify sales tax is a hot topic, so before we get into the intricacies, we want to offer you the big picture of Shopify sales tax.

We will discuss the many sorts of sales taxes, then delve deeper into how they operate, how to collect them, where to do so, and even offer assistance with all of your company's financials.

Because of where you live, the state in which your firm is located, and whether or not your products are taxable, it's a complicated matter.

To assist you in navigating Shopify's sales tax, we wrote this comprehensive guide.

Get started now!

What is Shopify Sales Tax?

Shopify sales tax is a small fraction of each transaction paid to the relevant regulatory agency for the sale of specified products and services. Despite the complexity and frequent changes in tax rules and regulations, Shopify may be configured to handle the majority of sales tax calculations automatically. You should be aware, however, that Shopify does not submit or file sales tax on your behalf. You may need to register your business with your local or federal tax authorities to manage your sales tax. When it comes time to file and pay your taxes, the computations and information provided by Shopify should be beneficial.

Remember that you do not own any of the sales tax you collect. Customers' Shopify sales tax is generally collected by the merchant, who subsequently pays the money to the appropriate state.

Being an online company, one of our advantages is that we don't just sell locally in our state. We have sales all across the United States and possibly the world. And what's this? Any sales made outside our home state are exempt from sales tax!

When it comes to a marketplace like Amazon, that is an entirely different story. All around the United States, Amazon maintains offices and fulfillment centers. Amazon must therefore collect taxes in the majority of American states.

But fortunately for small enterprises, you probably only have one location, so you can collect Shopify sales tax only in your own state.

How to Add Sales Tax to Your Shopify Store?

If you are pursued by the state because you failed to collect Shopify sales tax when needed, you will be compelled to pay the sales tax out of pocket. You may also be assessed some penalty fees. With this in mind, let's look at how to set up taxes on Shopify.

Following these simple instructions will make setting up Shopify's tax calculation a piece of cake.

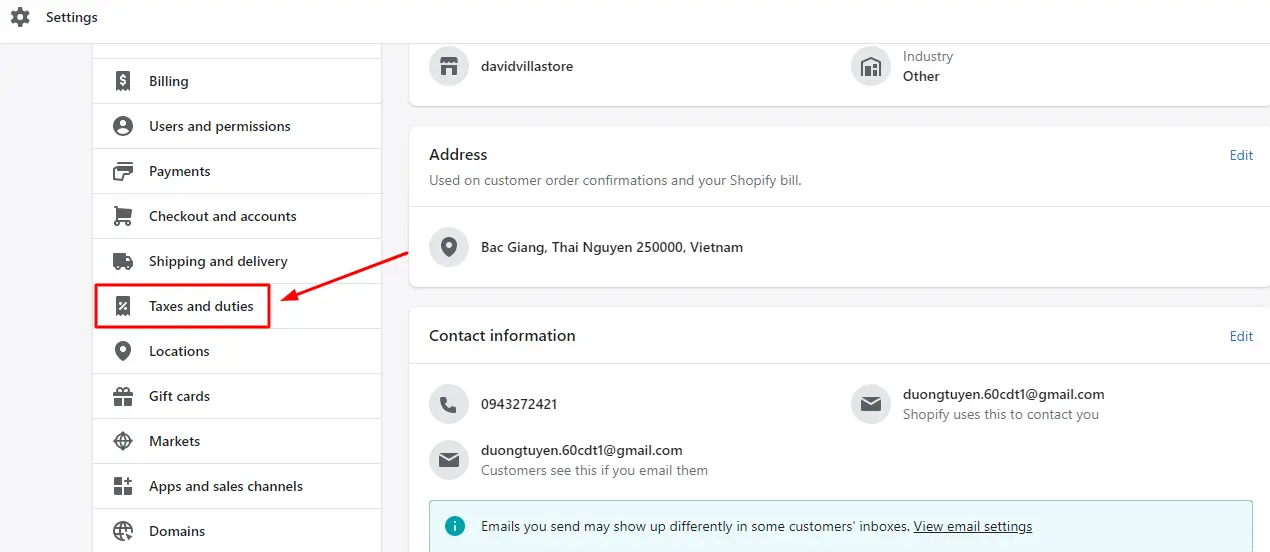

Tell Shopify Where to Collect Sales Tax

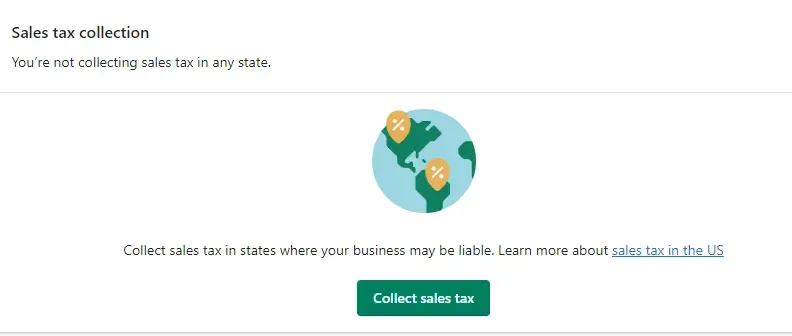

You must first specify which state Shopify should use to collect sales tax from customers. On the homepage, click Setting. Then click on “Taxes and Duties”:

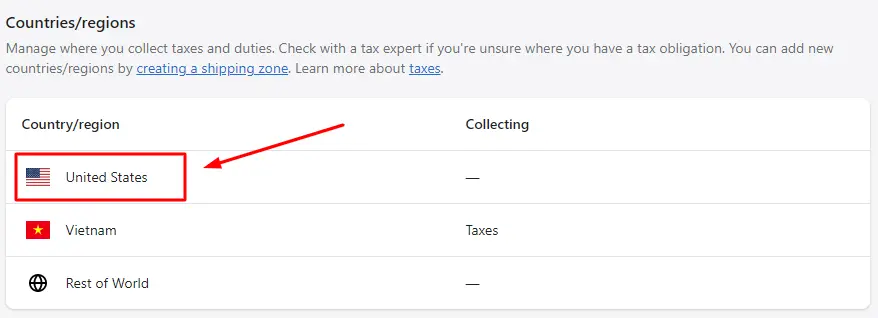

After that, click on the United States

Then click on “Collect Sales Tax”:

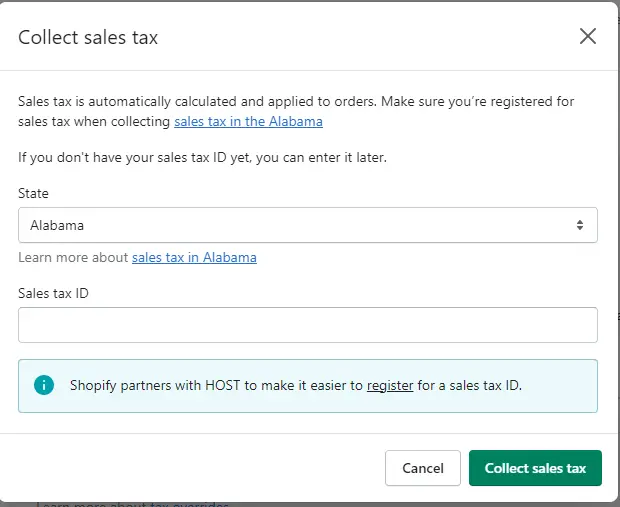

Finally, select any states where you should be collecting sales tax due to a physical or economic presence from the dropdown box. Depending on the version of Shopify you're using, you might need to input your sales tax permission instead of your zip code:

Set Up Shopify Tax Calculations

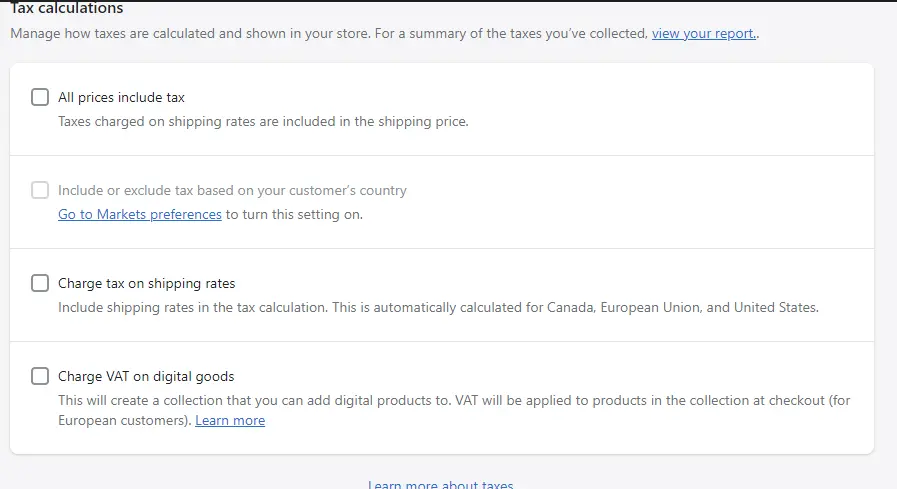

When you've filled in the Tax Areas section, move on to the next section—Tax Calculations.

You have four options to pick from. You can check more than 1 box.

If your business is located in a state with different shipping-related tax laws (e.g., California, Colorado, Florida, etc.), you can select whether or not you want to charge shipping. Or if you're not sure if you should charge shipping tax, leave this at the default setting and check with your U.S. state tax office or tax advisor.

Set Up Tax Overrides

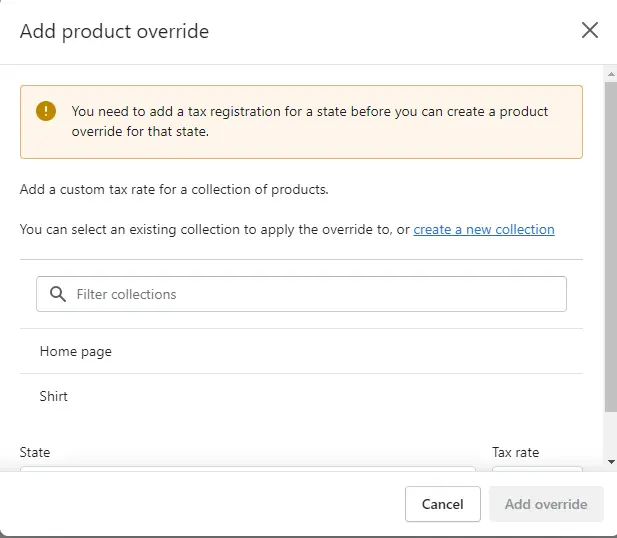

Sometimes the default tax rate does not apply to certain products. Creating product overrides is a two-step process. First, you create a collection that includes products with different tax rates. You then specify the region to apply the override and the tax rate to use.

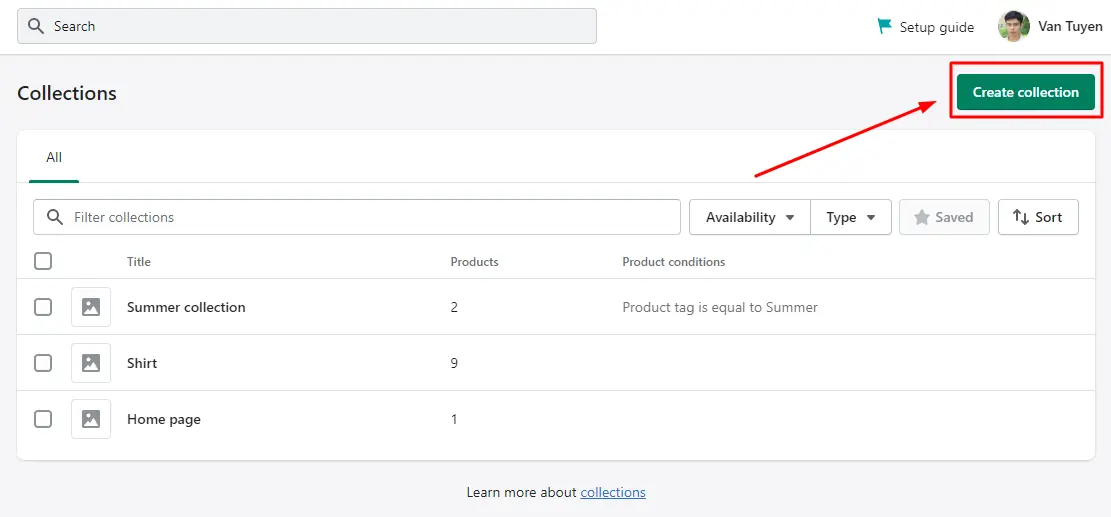

Create A Collection

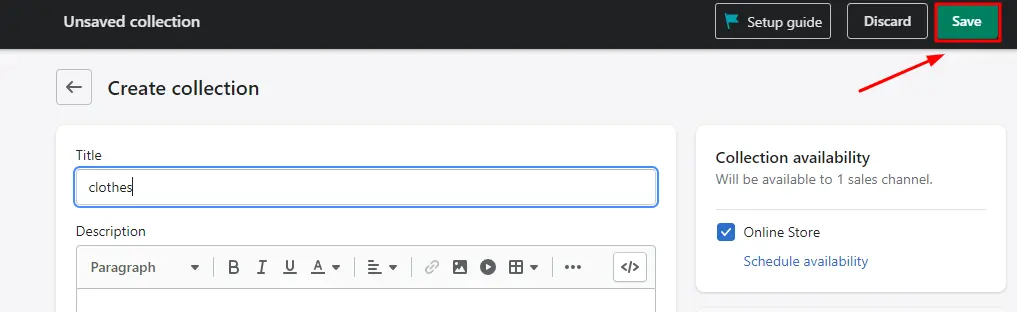

In your Shopify admin, navigate to Products > Collections. Then, on the left, click the green create collection button.

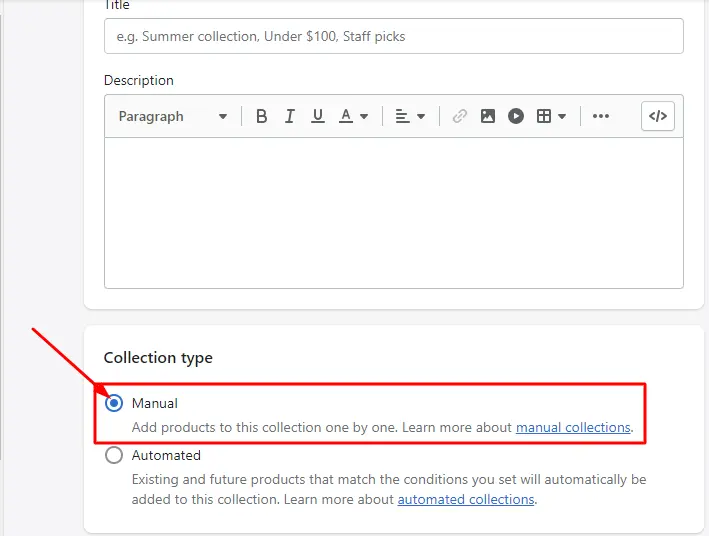

Give your collection a name. Select Manual as the collection type.

To finish, click Save.

Create the override

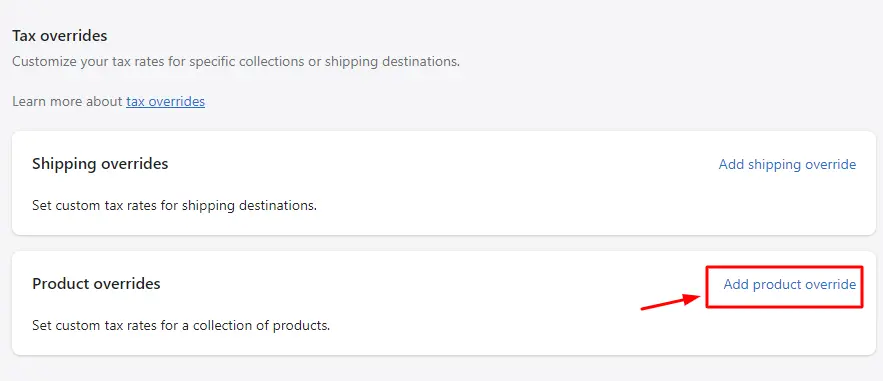

Navigate to Settings, then to Taxes > Tax overrides.

Then, select Add product override.

Then, pick the collection you just created and the region to which the override applies.

Finally, enter the tax rate for that region's collection.

3 Best Shopify Tax Apps in 2022

TaxJar

TaxJar or TaxJar Sales Tax Automation is a simple, reliable sales tax compliance tool for Shopify. This Shopify sales tax app is rated 4.7 out of 5 on G2 and recognized as a High Performer in the G2 Crowd High Performer for sales tax and corporate tax compliance.

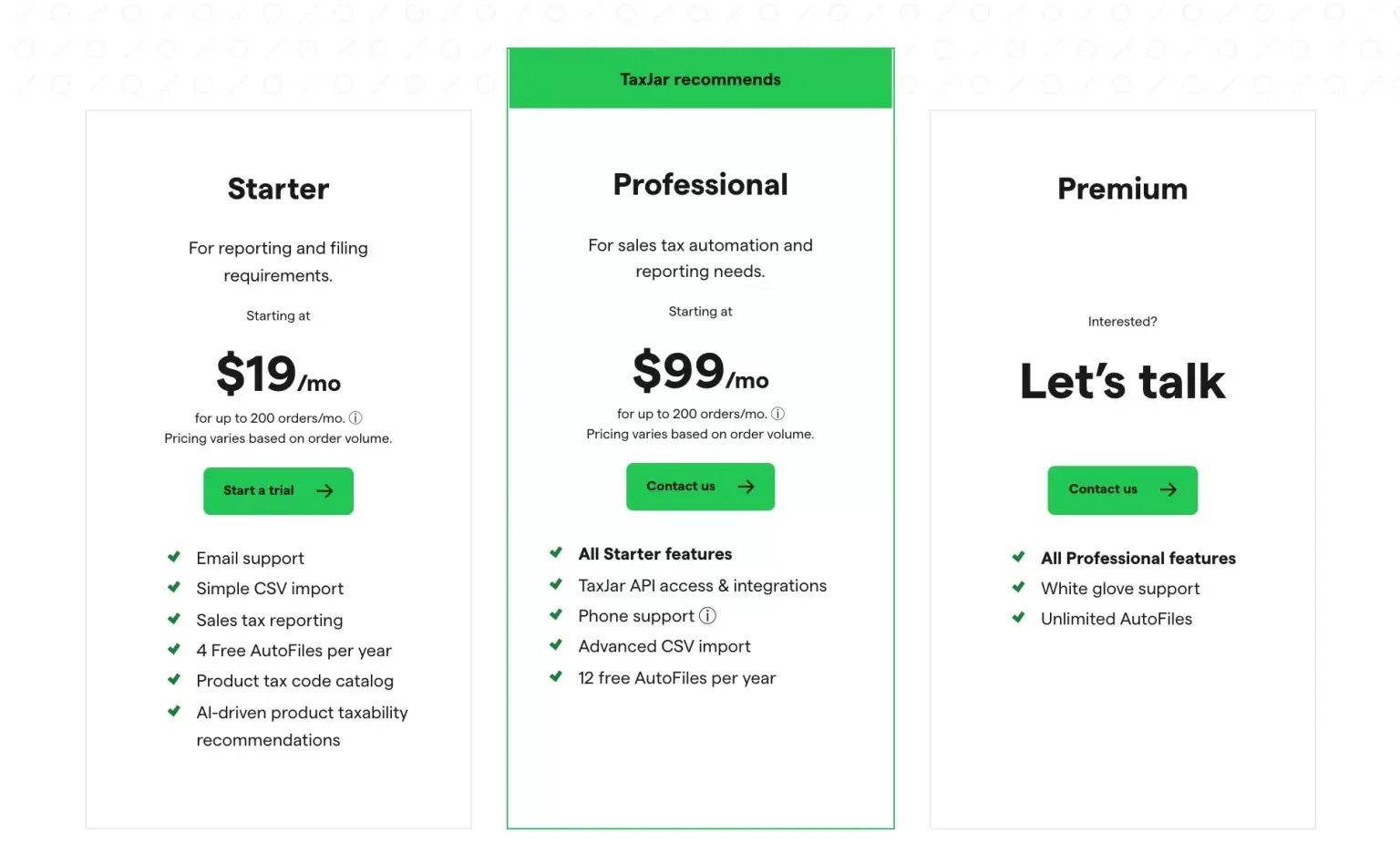

TaxJar now offers three pricing options: Starter, Professional, and Premium. First, you can use a 30-day free trial. And then, for as low as $19/month for the cheapest plan, you can start using TaxJar and let this Shopify tax app take care of all your tax problems.

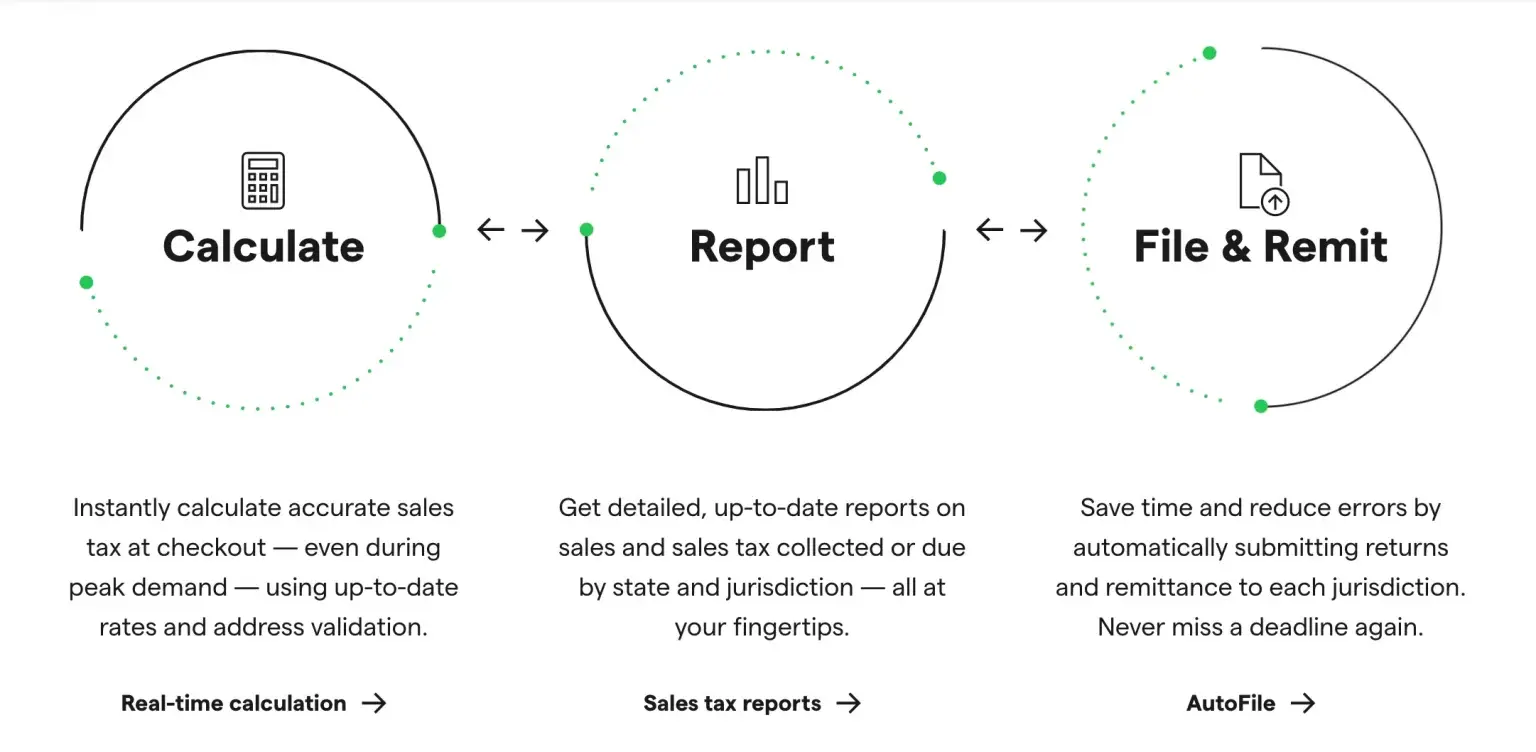

Here's how TaxJar for Shopify works:

- Connect TaxJar to your Shopify online store

- Prepare your Shopify sales tax report

- View reports and Autofill your sales tax forms

Please note that Shopify's built-in tax tool currently supports real-time calculations for Shopify stores at checkout, but does not transfer or pay you taxes. TaxJar can help export sales tax collected, recalculate it in your TaxJar dashboard for accuracy, and provide seamless automatic filing.

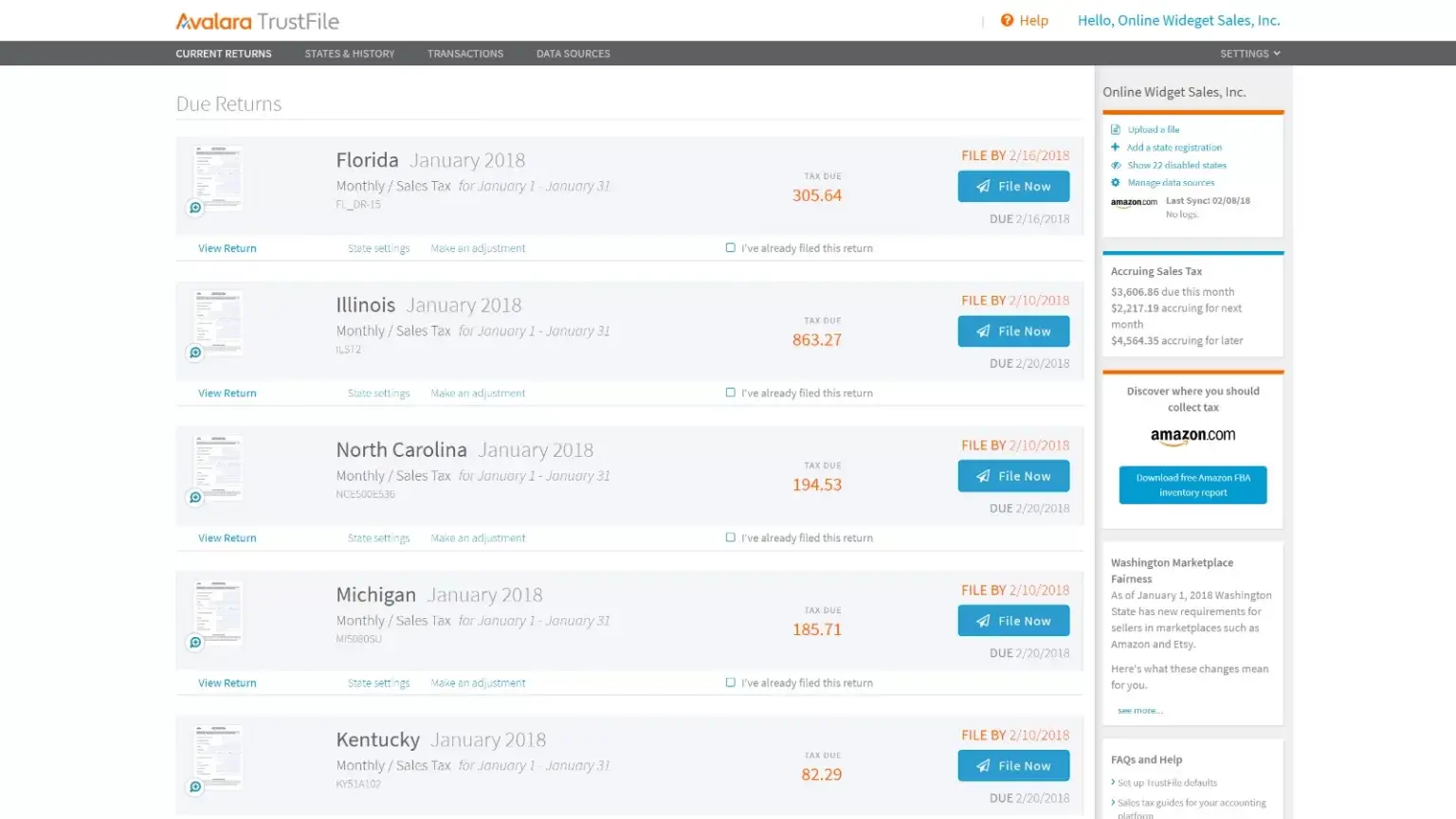

Avalara TrustFile

If you're researching Shopify sales taxes, chances are you've heard of Avalara TrustFile - a sales tax software that automates tax calculation and the tax return process. With the help of Avalara, you can check Shopify sales tax off your to-do list and back to boost your sales.

Avalara will cost you $24 per month—$5 more expensive than TaxJar's Starter plan, but cheaper than TaxJar's Professional plan. The point is that Avalara gives you unlimited customer support. Meanwhile, in the case of TaxJar, you only get phone support if you pay at least $99 per month for the Professional plan.

But just like TaxJar, you'll also get a month's free trial to explore Avalara TrustFile before deciding to commit.

See how Avalara TrustFile helps your business to stay compliant with up-to-date data for high accuracy

- Integrate with your Shopify online store to apply multiple tax rates automatically.

- Track rate changes for every address with geospatial targeting

- Track relationships and get notifications in each state with interactive maps

- Export and create aggregates for debits and sales tax exemptions

However, as great as Avalara TrustFile can be, it won't be the perfect Shopify tax app for every online seller. In fact, some of our customers have complained that they have experienced downtime while using Avalara.

Quaderno

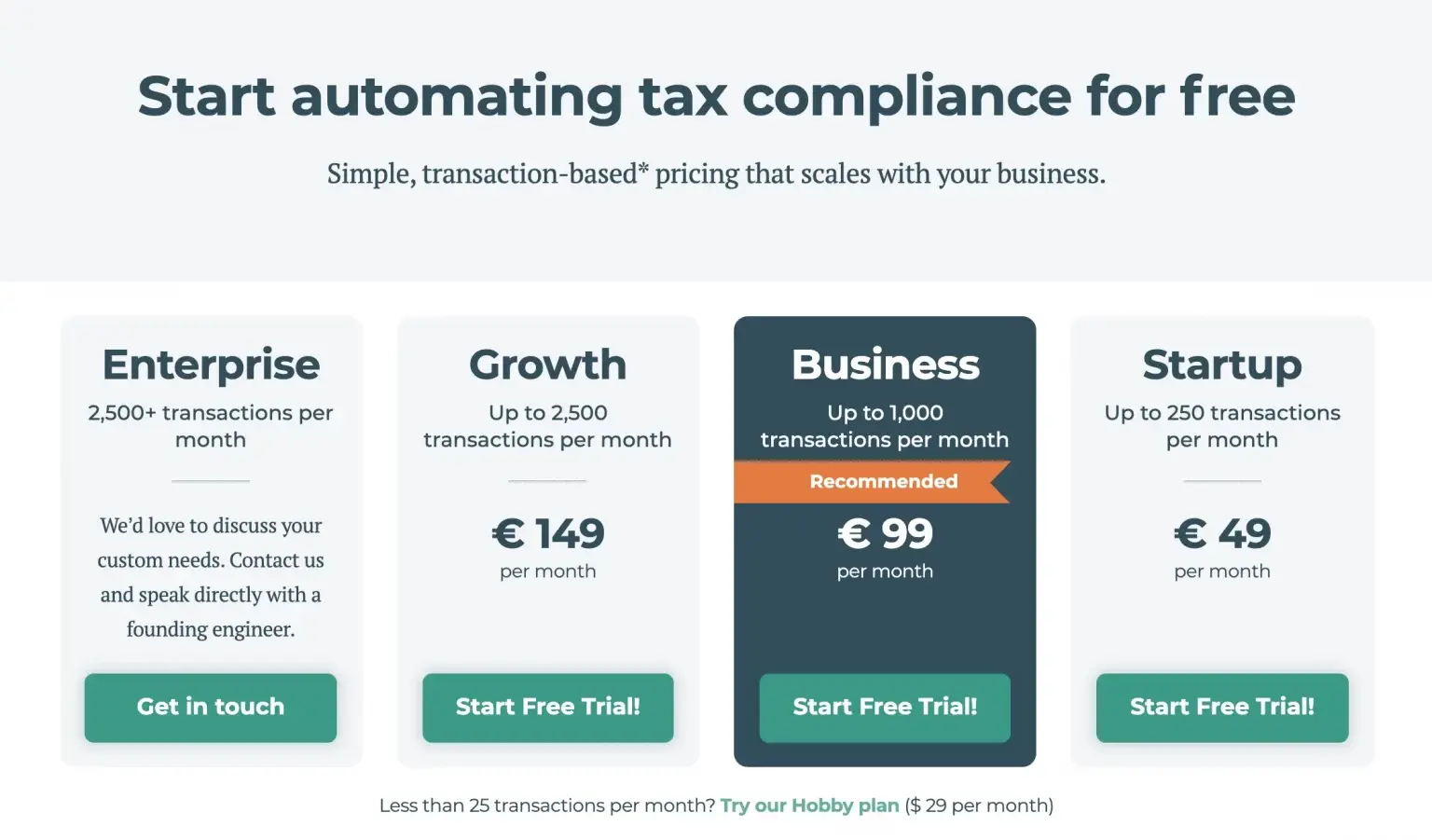

Really, there's no reason to stress about taxes when they can be automated with powerful, user-friendly software. It's Quaderno! This tax app was born to solve all your concerns regarding tax compliance, proper invoicing, bookkeeping, and tax payment.

One of the things that separate Quaderno from the two apps suggested above is that all of Quaderno's pricing plans are based on the number of transactions per month. Therefore, Quaderno is suitable for all sizes of businesses.

All these Quaderno plans include worldwide tax compliance, automated tax receipts, omnichannel tax reporting, international tax alerts, unlimited users, and first-class support. The free trial lasts for 7 days—a bit short, but enough for you to explore the outstanding features of Quaderno.

How Quaderno works with Shopify?

- eQuaderno integrates seamlessly with Shopify to collect your sales data in real time and start automating your Shopify sales tax process in minutes.

- It automatically calculates the correct tax rate for every transaction based on data provided by Shopify and outputs sales receipts customized for your brand, in the customer's native language, and in compliance with local taxes in their country or region.

- Quaderno provides all your financial data in easy-to-read reports, ready to share with your trusted tax advisor. So you can end the anniversary quarter, without paying too much.

Shopify Sales Tax FAQ

Why must Shopify sellers pay sales tax?

In 2018, the landmark case between South Dakota and Wayfair Inc. ruled that businesses no longer need a physical address in a state to be eligible to pay taxes. If your Shopify sales for a particular state reach an economically relevant threshold, or you store inventory there or have employees or affiliates there, you may need to collect and file sales tax for that state.

Does Shopify charge sales tax?

Shopify doesn't charge or administer sales tax for you. However, you can integrate the tax app with your store and change Shopify's settings so that each eligible transaction automatically applies the correct sales tax rate at checkout.

How to avoid sales tax on Shopify?

If your Shopify business is affiliated with a state, you are required by law to collect and pay sales tax for that state. If you are audited, failure to comply could result in fines and limited fees. You can sell tax-free items, and you can exclude these items from collecting sales tax by changing Shopify's settings. See its help page for instructions.

How to set up sales tax on Shopify?

Go to Settings > Taxes and select the relevant tax area. If you're selling in the US across multiple states, integrating your tax app with Shopify will help ensure you're collecting the correct amount for each state. More information on how to collect Shopify sales tax may be found in our guide here.

Does Shopify provide me with tax reports?

Shopify provides you with tax financial reports and sales financial reports. These data summarize your financial data to help you file and report taxes.

Is a sales tax license required to sell on Shopify?

Yes, a dropship partner is considered the relationship criterion. Any business you conduct through dropshipping is eligible for sales tax.

Does Shopify charge VAT?

If you do business with the UK or Europe, you will also need to check the sales tax and VAT rules of each country. They will have their own thresholds, and the tax app will help you determine the exact amount to charge and pay.

Conclusion

Everyone doesn't like taxes, but it's inevitable. Whether you hate them or not, it's always there. Hopefully, this article has brought clarity to all Shopify sales tax-related questions you may have.